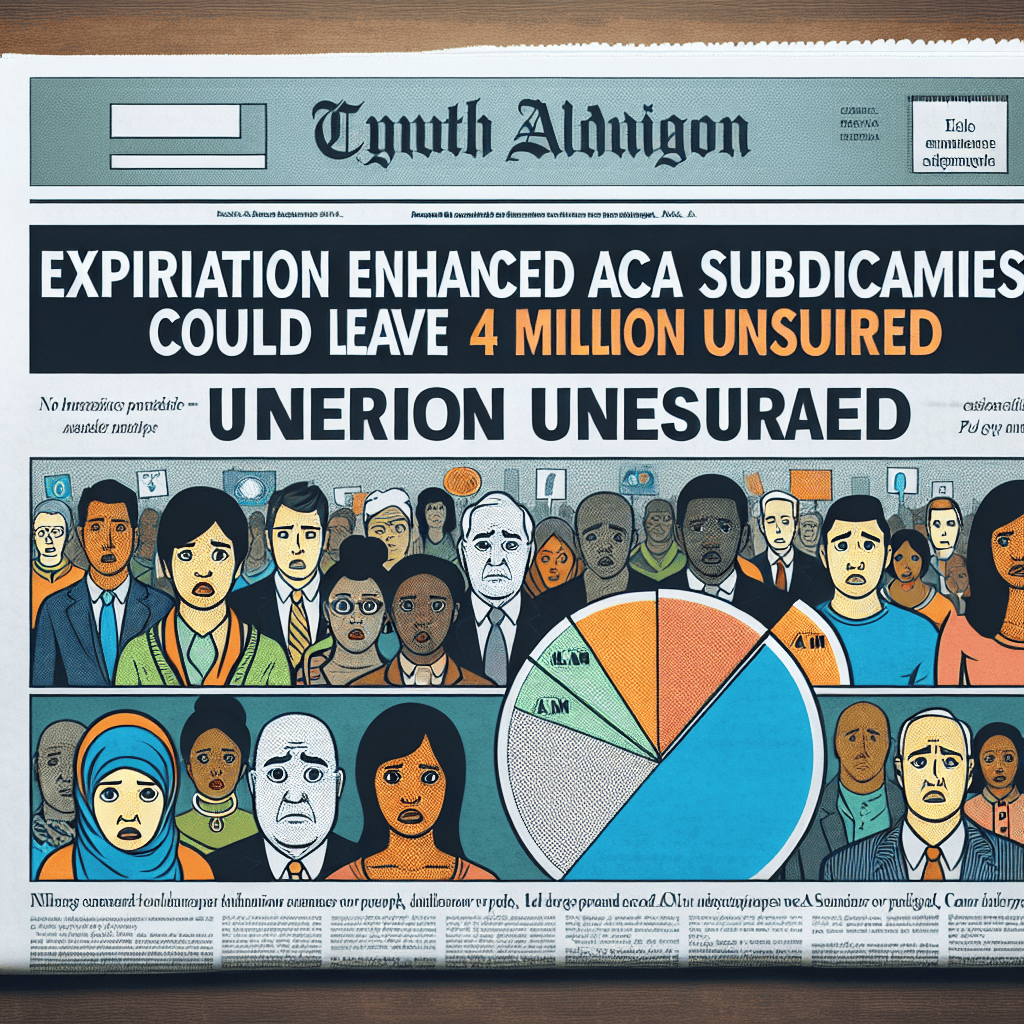

Report: Expiration of Enhanced ACA Subsidies Could Leave 4 Million Uninsured

The Affordable Care Act (ACA), a landmark piece of legislation in the United States, has undergone numerous changes since its inception. One of the most significant modifications came with the introduction of enhanced subsidies, which were designed to make healthcare more affordable for millions of Americans. However, these enhanced subsidies are set to expire, potentially leaving millions without insurance. This article delves into the implications of this expiration, exploring the potential impact on individuals, the healthcare system, and the broader economy.

The Background of ACA Subsidies

The Affordable Care Act, enacted in 2010, aimed to increase healthcare coverage and reduce costs for individuals. A key component of the ACA was the provision of subsidies to help lower-income individuals afford health insurance. These subsidies were calculated based on income and the cost of coverage in a person’s area, making insurance more accessible to those who might otherwise be unable to afford it.

In 2021, as part of the American Rescue Plan Act (ARPA), the federal government introduced enhanced subsidies to further alleviate the financial burden of healthcare during the COVID-19 pandemic. These enhancements increased the amount of financial assistance available and expanded eligibility to more individuals, including those with incomes above 400% of the federal poverty level.

The enhanced subsidies have been credited with significantly reducing the number of uninsured Americans. However, these provisions were temporary and are set to expire, raising concerns about the potential consequences for millions of people who have come to rely on this financial assistance.

The Role of Enhanced Subsidies in Expanding Coverage

The enhanced subsidies under the ARPA played a crucial role in expanding healthcare coverage. By increasing the amount of financial assistance available, more individuals were able to afford insurance plans through the ACA marketplaces. This expansion was particularly important during the pandemic, as many people faced economic hardships and job losses that affected their ability to maintain health coverage.

According to a report by the Department of Health and Human Services, the enhanced subsidies led to a record number of enrollments in ACA plans. The report highlighted that over 2.8 million people gained coverage during a special enrollment period in 2021, with many citing the increased affordability as a key factor in their decision to enroll.

- Increased affordability: The enhanced subsidies reduced premiums for millions, making healthcare more accessible.

- Expanded eligibility: More individuals, including those with higher incomes, became eligible for subsidies.

- Record enrollments: The ACA marketplaces saw a significant increase in enrollments due to the enhanced subsidies.

Despite these successes, the temporary nature of the enhanced subsidies has raised concerns about the sustainability of these coverage gains. As the expiration date approaches, policymakers and stakeholders are grappling with the potential fallout and exploring options to maintain coverage for those who stand to lose it.

Potential Impact on the Uninsured Population

The expiration of the enhanced ACA subsidies could have a profound impact on the uninsured population in the United States. Estimates suggest that up to 4 million people could lose their health insurance coverage if these subsidies are not extended or replaced with a similar form of financial assistance.

One of the primary reasons for this potential increase in the uninsured population is the affordability gap that would emerge without the enhanced subsidies. Many individuals who currently benefit from reduced premiums may find themselves unable to afford coverage once the subsidies expire. This is particularly concerning for those who fall just above the income threshold for traditional ACA subsidies, as they may face significant premium increases.

The impact of losing health insurance can be severe, affecting individuals’ access to necessary medical care and financial stability. Uninsured individuals are less likely to seek preventive care, leading to worse health outcomes and higher healthcare costs in the long run. Additionally, medical debt is a leading cause of bankruptcy in the United States, and losing insurance coverage could exacerbate this issue for many families.

Case Studies: The Human Impact of Losing Coverage

To understand the potential human impact of losing enhanced ACA subsidies, it is helpful to consider real-life case studies of individuals who have benefited from these subsidies. For example, consider the case of Sarah, a single mother of two who works as a freelance graphic designer. With the enhanced subsidies, Sarah was able to afford a comprehensive health insurance plan that covered her family’s medical needs. However, without these subsidies, her premiums would increase by over 50%, making it difficult for her to maintain coverage.

Another example is John, a small business owner who experienced a significant drop in income during the pandemic. The enhanced subsidies allowed him to keep his health insurance while he rebuilt his business. Without this financial assistance, John would have faced a difficult choice between paying for health insurance and investing in his business’s recovery.

- Affordability gap: Many individuals may find themselves unable to afford coverage without enhanced subsidies.

- Worse health outcomes: Uninsured individuals are less likely to seek preventive care, leading to poorer health outcomes.

- Financial instability: Losing insurance coverage can lead to increased medical debt and financial hardship.

These case studies illustrate the real-world impact of losing enhanced ACA subsidies and underscore the importance of finding a solution to maintain coverage for those who stand to lose it.

The Economic Implications of Increased Uninsurance

The potential increase in the uninsured population due to the expiration of enhanced ACA subsidies could have significant economic implications. The healthcare system, businesses, and the broader economy could all be affected by this change.

One of the most immediate economic impacts would be on the healthcare system itself. Hospitals and healthcare providers often bear the financial burden of treating uninsured patients, as they are required to provide emergency care regardless of a patient’s ability to pay. This can lead to increased uncompensated care costs, which are often passed on to insured patients in the form of higher premiums and healthcare costs.

Additionally, the loss of insurance coverage can lead to decreased productivity and increased absenteeism in the workforce. When individuals lack access to necessary medical care, they are more likely to experience health issues that prevent them from working. This can have a ripple effect on businesses, leading to decreased productivity and increased costs associated with employee turnover and absenteeism.

The Broader Economic Impact

The broader economy could also be affected by an increase in the uninsured population. When individuals face high medical costs without insurance, they may be forced to cut back on other spending, leading to decreased consumer demand. This can have a negative impact on businesses and the economy as a whole, particularly in sectors that rely on consumer spending.

Furthermore, the loss of insurance coverage can lead to increased reliance on public assistance programs, such as Medicaid and food assistance. This can strain state and federal budgets, leading to difficult choices about funding priorities and potential cuts to other essential services.

- Increased uncompensated care costs: Hospitals and healthcare providers may face higher costs due to treating uninsured patients.

- Decreased productivity: Health issues related to lack of insurance can lead to decreased productivity and increased absenteeism.

- Strain on public assistance programs: Increased reliance on public assistance can strain state and federal budgets.

These economic implications highlight the importance of addressing the potential increase in the uninsured population and finding solutions to maintain coverage for those who stand to lose it.

Policy Options and Solutions

As the expiration of enhanced ACA subsidies looms, policymakers and stakeholders are exploring various options to address the potential increase in the uninsured population. Several policy solutions have been proposed to maintain coverage and mitigate the impact of losing these subsidies.

One potential solution is to extend the enhanced subsidies beyond their current expiration date. This would provide continued financial assistance to individuals who have come to rely on these subsidies and help prevent a significant increase in the uninsured population. However, extending the subsidies would require legislative action and funding, which could be challenging given the current political climate.

Another option is to implement a permanent expansion of ACA subsidies, making them more generous and accessible to a broader range of individuals. This could involve adjusting the income thresholds for eligibility or increasing the amount of financial assistance available. A permanent expansion could provide long-term stability for individuals and the healthcare system, but it would also require significant investment and political will.

Innovative Approaches to Expanding Coverage

In addition to extending or expanding subsidies, there are several innovative approaches that could be considered to expand healthcare coverage and address the potential increase in the uninsured population. These approaches include:

- Public option: Introducing a public option for health insurance could provide an affordable alternative for individuals who lose coverage due to the expiration of enhanced subsidies.

- State-based solutions: States could explore their own solutions to expand coverage, such as implementing state-level subsidies or expanding Medicaid eligibility.

- Employer incentives: Providing incentives for employers to offer health insurance could help increase coverage among workers who may lose subsidies.

These innovative approaches offer potential solutions to address the challenges posed by the expiration of enhanced ACA subsidies and ensure that individuals have access to affordable healthcare coverage.

Conclusion: The Path Forward

The expiration of enhanced ACA subsidies presents a significant challenge for millions of Americans who rely on this financial assistance to afford health insurance. Without action, up to 4 million people could lose their coverage, leading to worse health outcomes, increased financial instability, and broader economic implications.

Policymakers and stakeholders must work together to find solutions that maintain coverage for those who stand to lose it. Whether through extending the enhanced subsidies, implementing a permanent expansion, or exploring innovative approaches, it is crucial to address this issue to ensure that all Americans have access to affordable healthcare.

The path forward will require collaboration, investment, and political will, but the potential benefits of maintaining coverage for millions of individuals and the broader economy make it a challenge worth tackling. By taking action now, we can prevent a significant increase in the uninsured population and ensure a healthier, more stable future for all Americans.